Aviva insurance is one of the more well-known names in the world of insurance in the United Kingdom. Around fifteen million people choose Aviva to protect their belongings. In 2018, Aviva paid out on 98% of claims put forward. Moreover, Aviva investors have invested over £6 billion in green assets, yes six billion.

What do customer reviews say about Aviva Insurance?

Aviva currently holds over 10,000 reviews on their Trustpilot profile with a rating of 4.6, a very respectful rating for an insurance company. However, 17% of those reviews are bad, whilst 71% are excellent.

One of the positive reviews by a customer (verified) said: “Very pleased with the ease of insuring with Aviva. If in the unfortunate event I have to claim on the insurance, I hope that I will be able to provide a 5-star rating at that time.”

On the other hand, a negative review by a customer named Oliver said: “We came home to find a leak from our bathroom to our kitchen today, which has resulted in damage to the ceiling and electrical lights. I contacted Aviva to be told that they will only cover damage to the ceiling and not the callout fee or work needed by a plumber. Excess for the ceiling is £450, which we were never notified of. I had tried to make a claim a few years ago for damage in bedroom by water issue from the roof, to be told this was not covered, even though it’s water damage. It seems like they will try to avoid paying out at any cost, please check before you buy. Should be called avoida not Aviva”

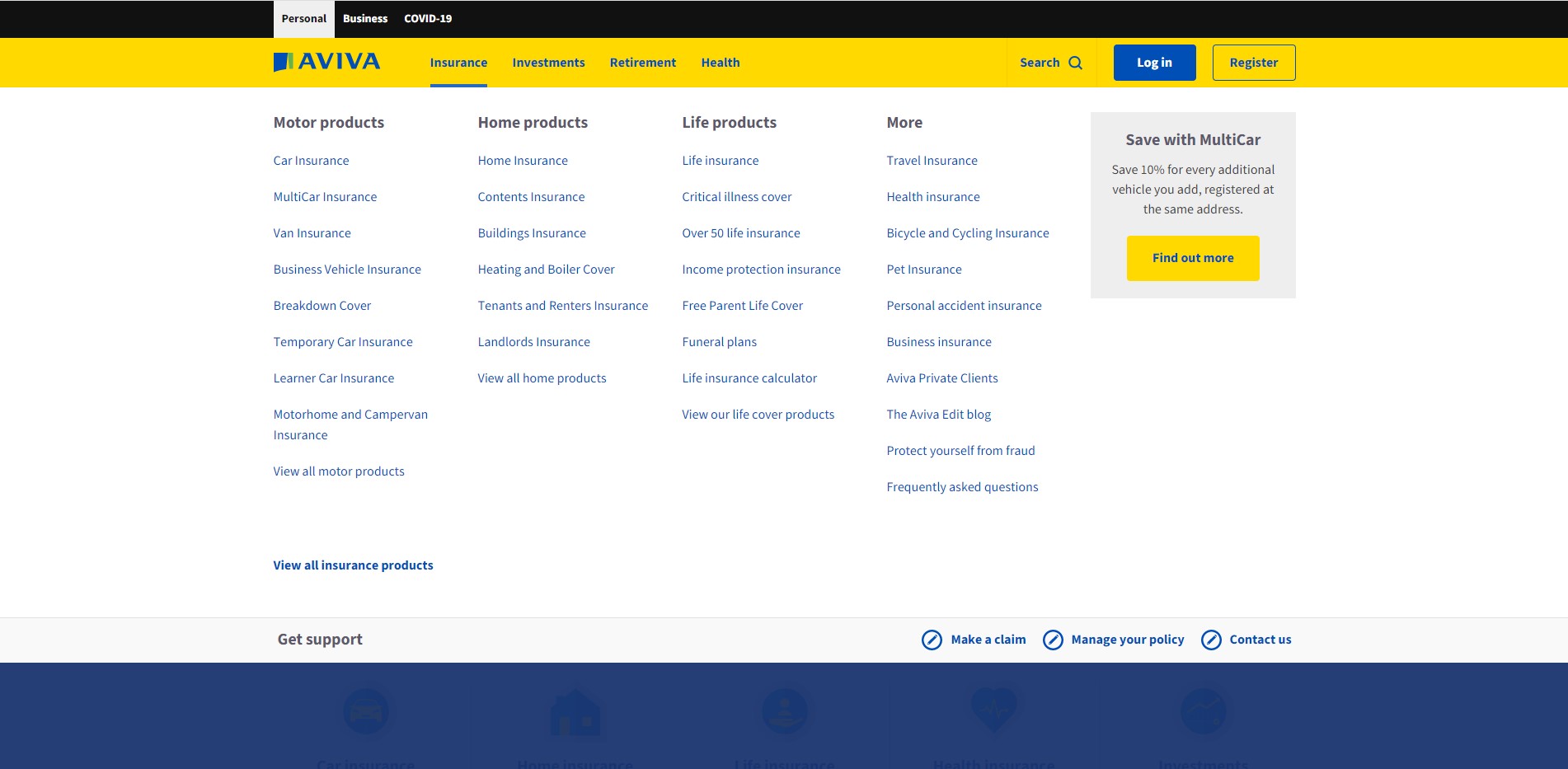

What type of insurance does Aviva offer?

Aviva has a vast range of insurance products. These include but are not limited to:

- Car insurance

- Van insurance

- Learner car insurance

- Home insurance

- Heating and boiler cover

- Landlords insurance

- Life insurance

- Travel insurance

- Pet insurance

- Business insurance

What investment products does Aviva offer?

Luckily for those looking to save some money for their retirement Aviva offers a few solid choices that are pretty appealing. Aviva does offer a pension plan which allows you to pay one single lump into your pension — at any time. Whilst also allowing you to put your hard-earned money into investments of your choice.

Aviva also offers Aviva stocks & shares ISA. To use this product, you must pay £50 a month. You can start with a sum of £500 or simply pay in as little as £50. Aviva allows you to track your ISA with their splendid online investment service. You can also take money from your ISA whenever you need to.

Is Aviva Car Insurance any good?

Like most car insurance plans, everything differs depending on the options you choose. However, here are some things that Aviva offer for you:

- They promise to refund any excess you’ve paid if you’ve been involved in an accident by an uninsured motorist.

- If your car is in bad condition and cannot run, they will take you home or take you and your car to get it repaired.

- They offer a three year guarantee on repairs carried out by their approved repairers.

Does Aviva car insurance cover tyres?

Aviva car insurance does not cover any punctures, cuts or bursts — including those caused by severe or limited braking.

What is covered by Aviva’s car insurance?

Luckily for Aviva users, you will be covered if your vehicle is lost, stolen or damaged and if you injure someone or damage their vehicle or property in an accident. Additionally, if you have an accident and your vehicle is not roadworthy, Aviva will take it to one of their approved garages.

Conclusion

Aviva has a good range of insurance covers, and most customers seem satisfied by their service. However, it’s worth knowing that they might not be the best option for you depending on if you require specific coverage such as electrical breakdown cover for your car or a more sophisticated platform to find out about your pension.